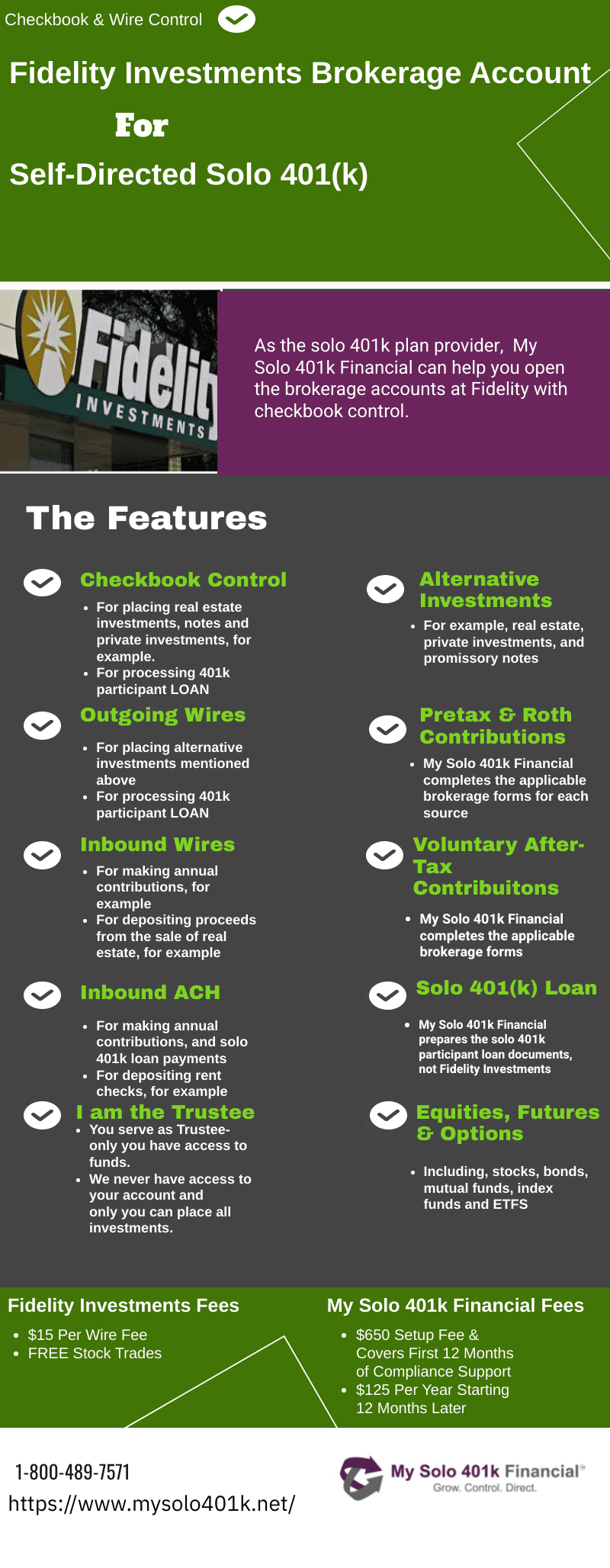

A Fidelity Investments Solo 401k brokerage account with checkbook control from My Solo 401k Financial is ideal for those looking to still have the option to invest in equities while also gaining checkbook control over their retirement funds for investing in alternative investments such as real estate, notes, tax liens, and private shares in addition to processing a solo 401k participant loan.

A Fidelity Investments Solo 401k with checkbook control allows for the following

Checkbook

Fund Solo 401k alternative investment purchases, e.g., real estate, precious metals, tax liens, promissory notes, private placements, etc. by writing checks from the Solo 401k Fidelity brokerage account.

Solo 401k Loan

After we prepare Solo 401k loan documents, process Solo 401k loan directly from the Solo 401k plan Fidelity brokerage account.

Brokerage

Continue to trade equities and grow your retirement funds tax-deferred, deposit investment gains from your Solo 401k’s alternative investment holdings (e.g., rent check proceeds from real estate) directly into your Solo 401k Fidelity brokerage account, and make your annual Solo 401k contributions directly into the brokerage account.

Timing of the Brokerage Account Setup

After submitting the Fidelity brokerage forms to Fidelity Investments, between 5-7 business days (not including Holidays), you should receive an email from Fidelity Investments that their system has updated your email address. This indicates the application is in processing.

When you start receiving emails from Fidelity, you can check if the account has been fully setup without having to wait on the Fidelity Welcome Letter in the mail which includes your new account number. Please try to log in using one of the following methods:

- If you have an existing Fidelity login (not NetBenefits), you should see the new Non-Prototype account appear under your portfolio with an account number that starts with the letter Z.

- If you do not have an existing Fidelity login, you can try to register to Fidelity.com at the following link: https://fps.fidelity.com/ftgw/Fps/Fidelity/RtlCust/Resolve/InitNUR You will need to create a username and password.

Flow of Funds

- Wire out – Requires Fidelity’s wire form directive which we can prepare for your submission to Fidelity’s local branch.

- Wire in – Click here to see special instructions for brokerage accounts.

- ACH out – Not currently enabled by Fidelity.

- ACH in – Click here to see special instructions. You can make your Solo 401k annual contribution into the Fidelity non-prototype account via ACH or by physical check. ACH transfers are set up on your bank side.

- Check-writing is enabled – Fidelity will send a checkbook for each account within 10 business days.

How it works

Fidelity is simply providing brokerage accounts for your Solo 401k, and My Solo 401k Financial is your Solo 401k provider. In other words, even though Fidelity also offers Solo 401k, their Solo 401k plan document restricts you to only investing in stocks and mutual funds; however, by using our Solo 401k document, which allows you to serve as trustee of the Solo 401k and invest in alternative investments such as real estate, precious metals, tax liens, promissory notes, private stock, etc., as well as process Solo 401k Loan, Fidelity is not involved in the administration of the Solo 401k.

Documents for Opening Fidelity Solo 401k Brokerage Account

To open Fidelity Solo 401k with checkbook control, you will need to submit My Solo 401k Financial Solo 401k plan documents, which we prepare in 24 hours, along with Fidelity’s special brokerage account forms and checkbook paperwork, which My Solo 401k Financial will fill out for you.

Fees Charged by Fidelity Investments

Because Fidelity is simply holding the funds in a brokerage account under the solo 401k offered by My Solo 401k Financial, the only fees that apply to the Fidelity brokerage account are:

Stock trading fees of ZERO; and

outgoing wire fees of $15.00 per wire.

Mega Backdoor Roth Solo 401k Using Fidelity Investments Brokerage Accounts

In-Plan Conversion Form

After-Tax to Roth IRA Conversion Form

ROTH IRA Statement from Fidelity Representative: QUESTION:

Can you confirm whether this statement is true or not (from a Fidelity representative). The IRS does not allow for Roth IRA money to be rolled into any 401k plan. That is only allowed on pre-tax IRA and retirement accounts. I was hoping to roll over a Roth IRA into my solo 401k roth account. Is this allowed?

The Fidelity representative is correct that a Roth IRA cannot be transferred to a Roth solo 401k. This is a Roth IRA rule. Visit here for more on this rule. I suspect this rule was put in place because the distribution rules are different for a Roth IRA vs a Roth solo 401k.

Processing Solo 401k Loan QUESTION:

I received the rollover check from John Hancock for my former employer 401k and will go into the local Fidelity Investments office tomorrow to deposit the check into the new brokerage account that you helped me set up for the self-directed solo 401k that you provide. I would like to make sure I understand the process to create a solo 401k participant loan against the balance. I think you all create the paperwork. What’s the method to move the loan amount from the fidelity account into my personal checking account. Do I just use the fidelity transfer functionality, get a check drafted or ?

Also, I will be rolling over an IRA account as well. Am I limited to 1 loan or can I take out a second loan against the additional amount?

ANSWER:

We will prepare the solo 401k participant loan documents (not Fidelity Investments) since we are the solo 401k provider. We prepare the solo 401k loan documents in 24 hours. Click here for what we need to prepare the solo 401k loan documents. Once the transfer check has cleared, you can process the solo 401k loan by check (one you receive the checkbook in the mail for the new self-directed solo 401k that you opened with us), our you can process the solo 4o1k loan proceeds by using the Fidelity wire form to request funds be wired from your Solo 401k to your personal bank account for the Solo 401k Participant Loan.

Why Solo 401k Loan not on Fidelity Statement QUESTION:

Looking at my solo 401k brokerage account and I’m confused on how the account is showing up. I wrote a check for the solo 401k participant loan proceeds , and it looks like the account is showing the actual balance has decreased. Is this just how Fidelity is accounting it or did this actually come from the balance as a withdrawal? Where can I see the actual loan balance/ information?

ANSWER:

Fidelity is merely the custodian of the cash (and other traditional investments such as any mutual funds, publicly traded stocks, etc.) in the solo 401k 401k. As such, any loans or alternative investments (e.g. real estate) will not be reflected on the Fidelity Investment brokerage account statement. Of course, you will be making solo 401k participant loan payments back to the Fidelity Investments brokerage account. So the deposits of those payments will be reflected on the Fidelity statements.

Rollover Existing Fidelity Solo 401k/KEOGH/PSP: QUESTION:

Can I rollover the current equity investment held in my current solo 401k through Fidelity to a self directed solo 401k with checkbook control for taking a 401k participant loan and for investing in alternative investments such as real estate, notes, tax liens and metals, for example? In other words, my new self-directed solo 401k would invest in the same Fidelity mutual funds initially before investing in real estate? I presume Fidelity Investments would simple re-title my current investments.

ANSWERS:

Yes your existing solo 401k with Fidelity Investments would get restated to our solo 401k plan which allows for 401k participant loans and investing in alternative investments such as real estate. We would then fill out new Fidelity brokerage account forms so that Fidelity can open a new brokerage account for the self-directed solo 401k that we offer. Note that Fidelity will not simply re-title the existing account. They require new brokerage forms. Subsequently, we would prepare an internal Fidelity transfer form to have Fidelity internally transfer the existing solo 401k equity holdings and cash to the new brokerage account for the self-directed solo 401k. You will then receive a checkbook in the mail from Fidelity for the new solo 401k for placing your alternative investments, and/or you can process the investments via wire.

Placing Real Estate Investment QUESTION:

I think I’m all set now with Fidelity brokerage account for the self-directed solo 401k that you guys helped me to open. I deposited my rollover check with no issues at the local branch. I also signed up for check writing and have received my checks in the mail yesterday. Is there anything I would need to do before I just write a check for an investment for example, to invest in a real estate deal?

ANSWER:

That is good news, and it sounds like the Fidelity brokerage account set up up process went smoothly and now you can start placing investments in alternative investments such as real estate. You can either place the investments by writing a check or by filling out the Fidelity outgoing wire directive, which we can fill out for you. Click here for more information regarding investing in real estate.

Direct Rollover Check Question:

I received my direct rollover check from T. Rowe Price. Should I send the rollover check to you or directly to Fidelity once the Fidelity brokerage account for my self-directed solo 401k account has been opened?

Answer:

Since you have received your transfer check from T. Rowe Price, the next step is to deposit your transfer check into the Fidelity Non-Prototype account for the self-directed solo 401k. Below are the steps to do so:

Process Alternative Investment by WIRE Question:

Also, is it possible to move (i.e. wire) funds directly out of my Fidelity brokerage account under the solo 401k electronically for investments in alternative investments like real estate and notes?

Answer:

Yes, because we are the solo 401k plan provider and provide the compliance support, the Fidelity non-prototype retirement brokerage account allows for outing wires (not outgoing ACH). To initial the outgoing wire, a specific Fidelity wire directive form is required which we can prepare for your submission to the local Fidelity branch. Lastly, while Fidelity does not allow for outbound ACH outbound, inbound ACH is possible. This could come in handy for setting up the return of income from solo 401k alternative investments like real estate investments as well as note investments, for example.

Deposit the check at Fidelity Please write the Fidelity account number for your account that starts with the letter “Z” in the memo section of the check. Please then take the check to your local Fidelity branch. You can find the nearest Fidelity branch using Fidelity’s online branch locator: http://www.fidelity.com/branchlocator/Alternatively, you can mail the check to Fidelity Investments: Fidelity Investments 100 Crosby Parkway, Covington, KY 41015 If applicable, these will be the same instructions you will follow when you receive your transfer checks from other companies. Send Direct-Rollover Check to Me or Fidelity Investments QUESTION: Do I want the direct-rollover check from my former employer 401k plan held at Principal sent to me or directly to Fidelity for deposit into my self-directed solo 4o1k brokerage account?

Answer:

It is recommended that the directed-rollover check that is made payable in the name of the self-directed solo 401k for your benefit is mailed to you as the participant to avoid it getting lost at Fidelity while the brokerage account (non-prototype brokerage account) is being established. When you receive the check, make sure the check was made payable in the name of the solo 401k plan. When the non-prototype brokerage account has been opened with Fidelity, write the new Fidelity “Z” account number for the self-directed solo 401k on the memo section or back of the rollover check and deposit it at your local Fidelity branch.

Roth 401k and After-Tax QUESTION:

Now that I have opened my solo 401k with you guys (see attached signed forms), I would like to proceed with the Fidelity brokerage account with the checkbook control option. I will be making ROTH contributions an after-tax contributions only. Is this okay?

ANSWER:

Correct that you are not required to make pre-tax solo 401k contributions but may do so at a later date.

We will provide two sets of Fidelity brokerage account forms tomorrow-one set for the Roth 401(k) funds in the second set for the after-tax 401k funds. Both brokerage accounts can be opened with a zero balance.Also, once you have funded the after-tax brokerage account, please let us know and we will email you the in-plan conversion procedure so that we can document the in-plan conversion of after-tax solo 4o1k funds to the Roth solo 401k and issue the required Form 1099-R to report the non-taxable conversion, so please make note of this.

Submit Solo 401k Contribution QUESTION:

Can I submit my solo 401k contributions to Fidelity Investments by check or by wire transfer?

ANSWER:

Once the Fidelity brokerage accounts have been opened, you can make the solo 401k contributions by check by going to your local Fidelity branch or by ACH or by wire. See the following. Fidelity ACH Instructions:https://www.fidelity.com/cash-management/deposit-money/determine-routing-and-account-numberFidelity Wire Instructions for Brokerage Accounts:https://www.fidelity.com/cash-management/information-needed-wire-to-fidelity-account In sum either method is allowed since the funds will flow directly into the solo 401k brokerage account.

Convert Existing Fidelity Solo 401k and Take a 401k Participant Loan QUESTION:

I was looking for a 401k alternative to Fidelity and stumbled on your site and wanted to send an email with a few questions. I am in the process of buying a new house and was hoping to take a loan out from my solo / self employed 401k plan at fidelity; however to my surprise they said that my 401k plan doesn’t have the loan feature because it is a self employed / small business type. Needless to say I am looking for a new 401k provider where I can transfer my and my wife’s 401k monies from fidelity and shortly after take a loan for the down payment. Does this sound like something you folks would be able to help me with? If this sounds doable, please give me a call when you have some time to go over next steps.

ANSWER:

Your situation is quite common among our clients as we have many clients who have converted from a Solo 401k at Fidelity (i.e. restatement) so that you can take a solo 401k participant loan. Please note that we will prepare the required loan documents as part of our services for no additional charge. Moreover, if you will use the loan proceeds to purchase your primary residence the term of the loan can be as long as the term of your mortgage (e.g. 30 years). Once we prepare the solo 401k loan documents and you process the loan proceeds from the new Fidelity brokerage account, below are the options for making participant loan payments from you personal bank account into the Fidelity brokerage account: Making Solo 401k Loan Payments: Method 1) Loan payments can be made by check payable in the name of the solo 401k trust and deposited at your local Fidelity branch. Make sure to write “Participant Loan Payment” on the memo section of the check. Method 2) Loan payments to the solo 401k trust can also be made by direct deposit via ACH payments.How to find your Fidelity brokerage routing number and 13 digit account number: 1. Log into your account on Fidelity.com 2. Click on the Non-Prototype account for your Solo 401k. 3. At the top, Click on the link labeled: “Routing Number” Please let us know if you have any questions as we are here to help.

Convert After-Tax Solo 401k Funds to Roth IRA QUESTION:

I would like to roll over the balance in my Solo 401k Fidelity brokerage after-tax account into a Roth IRA account. If possible, I would like to transfer the money to an external Roth IRA that is managed by my financial adviser. Since I have never done this before, I have two quick questions for you: First, is this an allowable transaction? If I recall correctly, in-service rollovers are allowed, but I wanted to double check. Do I need to transfer the after-tax money to my Solo 401k Roth Fidelity brokerage account first and then roll it over to the external account? ANSWER: Yes our solo 401k plan document allows for after-tax solo 401k contributions and the rules allow for the conversion of after-tax 401k funds to a Roth IRA. As part of our ongoing compliance support, we assist in both documenting and reporting the conversion of after-tax solo 401k funds to a Roth IRA. Moving the Funds From the after-tax solo 401k account to the Roth IRA:By check. If you have received your checkbook from from Fidelity for your after-tax solo 401k brokerage account, make a check payable from the after-tax solo 401k account in the name of ROTH IRA custodian, write “After-Tax 401k Conversion” on the memo section of the check along with the Roth IRA account If you have not received the checkbook, then you can use a Fidelity form which we will complete and provide. On the form, you can elect to have the check mailed out to the Roth IRA custodian.

Nonprototype QUESTION:

My Fidelity brokerage account for the solo 4o1k that you provide is created and the description says “NON-PROTOTYPE” Is this how it is supposed to read?

ANSWER:

Yes, that is how Fidelity Investments labels brokerage accounts for self-directed solo 401k plans offered by My Solo 401k Financial because the solo 401k is not being provided by Fidelity.

Checkbooks QUESTION:

Now I have two non-prototype accounts with Fidelity opened. I dedicated one for pre-tax and one for Roth.

How do I get my checkbook accounts? I did not see it in the instructions. Or do I have to open the accounts myself? I need one for pre-tax, and another one for Roth.

ANSWER:

The check-writing feature is enabled and one of the forms you signed is called Check-writing Form. Once the account is funded initially, Fidelity will then process and mail you a checkbook for each source of funds (pretax and Roth). This process can take up to 2 weeks. They cannot issue a checkbook with a $0 balance per their policy.If you need to fund an investment sooner or take out a solo 401k loan, we can provide a wire form.

Former Employer 401k Plan at Fidelity QUESTION:

Could my wife transition her former employer 401K at Fidelity (limited to a handful of mutual funds) to MySolo401K using Fidelity as the brokerage and invest in all allowed 401K options (such as passive real estate)?

ANSWER:

If your wife is self-employed with no full-time W-2 employees, she can certainly set up our solo 401(k) and then rollover funds from her former employer plan to a brokerage account at Fidelity (which we would set up as part of our services for no additional charge) and then invest those funds via the brokerage account or an alternative investments such as passive real estate since the account will be governed by our IRS approved 401(k) plan documents.

Distinguishing Account Sources QUESTION:

Thank you for assisting me in opening the three brokerage accounts with Fidelity under your self-directed solo 401k. To recap, I now have the following 3 (three) brokerage accounts at Fidelity:

- One for my Roth solo 401k funds

- Second one for my Pre tax solo 401k funds

- Third one for my After-tax solo 401k funds

They all have a zero balance since I just opened them, but they are not labeled accordingly. How do I distinguish them?

ANSWER:

After you sign in to view your Fidelity Investment non-prototype solo 401k brokerage accounts, you will see a list of accounts. You will then click one of the brokerage accounts, then click on “customize” at the top

and the following window launches labeled “Customize Accounts & Settings” where you can rename the accounts.

You would repeat this step for each brokerage account. See the following link for more on this: https://www.fidelity.com/products/atbt/help/ActiveTraderTools_AccountGroups_Help.html

Options Trading QUESTION:

Can I trade options in this solo 401k brokerage account at Fidelity?

ANSWER:

Yes our self directed solo 401k plan allows for options. Additional steps to add it to the non-prototype account at Fidelity will apply. Please review the information at Fidelity.com: https://www.fidelity.com/customer-service/how-to-add-options-trading-to-your-account

Also, once your new Fidelity Non-Prototype has been opened, you will be able to add options trading to your account by logging on to your account and following the following instructions.

- Once account is established will go to Fidelity website

- GO TO: Accounts & Trade (on left hand corner)

- CLICK ON: Account Features

- CLICK ON:Brokerage and Trading

- CLICK ON:Option

- CLICK ON:Apply

- Fill out Options Agreement (online and submit online-nothing to sign)

Letter form Fidelity Investments Regarding UBIT QUESTION:

I recently went through the process of applying for the ability to trade options in my Fidelity account. Last week I received a letter from Fidelity saying that I will be responsible for filing IRS Form 990T.

Questions:

- Is trading options in my solo 401k allowed?

- Is it a problem if Fidelity requires margin on the account in order to trade options?

- Assuming it’s allowed, is the Form 990T filing something that you will do for me each year?

ANSWER:

While the solo 401k plan already allows for investing via margin, a factor to consider is whether investing in margin will subject your investment to Unrelated Business Income Tax

https://www.mysolo401k.net/margin-account-and-solo-401k/

https://www.mysolo401k.net/yes-ubit-applies-to-margin-trading-court-case/

Form 990-T is used to report unrelated business income tax and would not apply to a Solo 401k that is invested in stocks, mutual funds.Please reach out to us directly and we will provide a CPA firm contact that specializes in Form 990T preparation and filing.

Private Investment QUESTION:

I am ready to wire money from Fidelity for one private equity investment. Do I need to fill out any paperwork before I wire money? How is the tax part handled when the returns are deposited in my account? I am guessing the investment will be in the name of the Trust?

ANSWER:

Yes you will need to list the solo 401k plan as the investor in all of the private fund purchase documents. You can also use the “General Investment” form on our website to document the investment. Note that you will not submit any of these mentioned documents to Fidelity Investments because they are not the Trustee of the solo 401k plan–your are the trustee, so you will safe-keep these investment documents. However, you will submit the Fidelity wire directive to have the funds wired from the solo 401k plan to the investment sponsor. When you are ready to make the investment, we can assist you in filling out Fidelity’s wire directive. To view a sample procedure when investing in a private fund, pleases CLICK HERE. With respect to your question regarding the flow of the profits generated from the private investment, they will flow to the solo 401k brokerage account and continue to grow on a taxed deferred basis because a solo 401k plan is a tax sheltered vehicle.

Commercial Property Private Investment QUESTION:

I’m interested in using my 401k funds to invest in a commercial property. I along with two others would be 20% owners while one other individual would be 40%. Is it as simple as writing a check from my Fidelity account?

ANSWER:

Yes it is simple as that in terms of transferring the funds. Please note the Solo 401k’s ownership interest must be reflected on the documents (e.g. if it is a multi-member LLC the operating documents would reflect that the Solo 401k is a member, a K-1 would be issued in the name and EIN of the solo 401k).

2019 Solo 401k Contribution QUESTION:

Now that I have opened up the checkbook brokerage account for my solo 401k plan at Fidelity, can I make my 2019 contributions now in full or in part?

ANSWER:

Yes -the annual solo 401k contributions would get deposited in the new Fidelity Investments brokerage account titled in the name of the self-directed solo 401k. Please note that it is imperative that you will ultimately have and report the self-employment income to justify the solo 401k contributions (otherwise you will end up in an over-contribution situation which may be practically very difficult to reverse if the funds have been invested in real estate).

Commingle Pretax and Roth Solo 401k Funds in Same Brokerage Account QUESTION:

Can I make Roth solo 401k contributions to the same Fidelity Investments brokerage account that holds my pre tax solo 401k contributions?

ANSWER:

No – Roth designated account contributions must be made to a separate sub-account (Fidelity brokerage account) in the name of the solo 401k plan and under the same EIN of the plan.

After I Submit the Brokerage Forms to Fidelity, How Quickly Before it is Available for Use QUESTION:

What phone number should I contact Fidelity at if I wanted to check on the status of my brokerage account application for the new solo 401k plan?

ANSWER:

Fidelity’s phone number on the application is 800-343-3548. Depending on how busy Fidelity is, processing times can take up to 5 business days (not including holidays), to open the brokerage account. Within this time range, you should receive an email from Fidelity that their system has updated your email address. This indicates the application is in processing. When you start receiving emails from Fidelity, you can check if the account has been fully set up without having to wait on the Fidelity Welcome Letter in the mail which includes your new account number. Please try to log in using one of the following methods:

- If you have an existing Fidelity login (not NetBenefits), you should see the new Non-Prototype account appear under your portfolio with an account number that starts with the letter Z.

- If you do not have an existing Fidelity login, you can try to register to Fidelity.com at the following link: https://fps.fidelity.com/ftgw/Fps/Fidelity/RtlCust/Resolve/InitNUR You will need to create a username and password.

How Quickly are My Funds Available Once in the Fidelity Investments Brokerage Account QUESTION:

Once my former employer and or IRA funds have been deposited into my new Fidelity non-prototype brokerage account for the solo 401k plan, how quickly can I access the funds for placing alternative investments such as real estate or to take a solo 401k participant loan?

ANSWER:

Typically, when funds are deposited, they take 3-5 business days to fully clear in the account. Although you can use the funds almost immediately for stock trading purposes, you are unable to use the funds for 3-5 days.

You can check the status of the funds by logging into your account on Fidelity.com and clicking the Balances or Positions Tab. You will see “Available to Trade” and “Available to Withdraw”. Once you see the funds in the “Available to Withdraw” position, you can complete the alternative investment or solo 401k participant loan by wire. Once submitted, the wire is typically completed the same day, so the funds will move quickly.

Rollover of Former Employer 401k plan Held at Fidelity Investments After Participant Loan Payoff QUESTION:

For my existing 401k account with Fidelity from my previous employer, I am ready to do the rollover after the 401k participant loan payment I had on the account and been paid off. I want to check if I should wait for the new Fidelity brokerage account for the solo 401k plan that I opened with your company before I request the direct-rollover of the former employer 401k , or I can request the direct-rollover check now?

ANSWER:

To keep the process going, you should request it now. Then when the new brokerage account for the Solo 401k is open at Fidelity, you should have the rollover check and can deposit it into the new Solo 401k brokerage account.

Transfer Electronically Former Employer 401k plan Held at Fidelity Investments QUESTION:

Can I transfer my former employer 401k plan currently held at Fidelity Investments electronically instead of having them send a check out since I will also use Fidelity to hold my new self-directed solo 401k for investing in alternative investments in processing a solo 401k participant loan?

ANSWER:

It is not possible to transfer funds from a former employer 401k as an electronic transfer. The practice of Fidelity (and the industry generally) is to process rollovers from a former employer plan via check (even if the account for the new 401k is at Fidelity). Even if you convinced a Fidelity representative to process as an electronic transfer, Fidelity would ultimately code and report this as a taxable distribution which would create problems down the road as the IRS would likely send you a deficiency letter (since you would not report this on your 1040 as income even though Fidelity reported it as a taxable distribution).

Bitcoin/Cryptocurrency Investment QUESTION:

Can I invest my checkbook control solo 401k Fidelity brokerage account in bitcoin or cryptocurrency?

ANSWER:

While the solo 401k that we offer allows for investing in cryptocurrency, the Fidelity brokerage account that we helped you to open at Fidelity can’t be used to invest in cryptocurrency because Fidelity is unable to link the brokerage account to the crypto exchange. The Fidelity account is a brokerage account, not a bank account. Although it does come with a checkbook. However, when investing in crypto, the crypto provider requires the crypto account linked to the solo 401k bank account. Therefore, you will still need a separate bank account under the solo 401k bank account. When you open the solo 401k bank account at the local bank, see the following banking guide. https://www.mysolo401k.net/solo-401k-bank-account-tips-self-directed-401k-bank-account-guide/If your bank has any questions, we can also put together a bank account packet.Learn More about the latest Fidelity announcement that they will allow Bitcoin 401k and how to open Crypto Solo 401k at Fidelity – CLICK HERE

Returning COVID-19 Distributions to My Self-Directed Solo 401k QUESTION:

I have taken 2 coronavirus-related distributions totaling $79,977.09. The first was $29,977.09 from a traditional 457, and the second was from a 403b ($284.89 pre-tax) $49,715.11 ROTH. The funds are currently in my credit union account. I would like to use this money to fund my solo 401k. I would like to convert all the pre-tax money to Roth asap. I am uncertain of how to process the paperwork to accomplish this.

ANSWER:

Distributions stemming from COVID-19 relief need to be deposited to the same sources–that is, the Roth funds need to be deposited into the Roth solo 401k account and the pretax funds need to be deposited into the pretax solo 401k. Once the new Fidelity solo 401k brokerage accounts have been opened, you can deposit the funds from your personal bank account into the respective solo 401k brokerage accounts and can do so electronically (ACH) Click here to see special instructions. As far as processing a conversion, once the pre tax funds get deposited into the pretax solo 401k brokerage account, you can convert the pretax funds to the Roth solo 401k. Please fill out the following online conversion form at that time so that we can collect the necessary information to report the taxable conversion to the IRS on Form 1099-R. https://www.mysolo401k.net/pretax-to-roth–solo-401k-in-plan-conversion-form/

Fidelity G Number QUESTION:

Fidelity assigned a G number to my new solo 401k brokerage account and I can’t trade on my account– what do I do?

ANSWER:

This is actually quite common and an easy fix and it can be corrected with a simple Secure Message or phone call to Fidelity. During set up, for security purposes, Fidelity assigns what is called a G-number to use in place of your SSN. Once set up this needs to be updated to your SSN so you can trade. You can either log into your account and send a secure message (example below) or you can call Fidelity and have them update to your SSN so you can trade. It is an easy fix. Please let us know if you have any trouble or need us to be on the call.

Feel free to copy and paste the example below:

I am unable to trade on my newly established Non-prototype accounts. Please update the G-number assigned to my accounts to my Social Security number so I am able to trade. Please feel free to contact me if you have any questions.

Real Estate Syndication Private Investment Using My Fidelity Solo 401k Brokerage Account QUESTION:

I am looking to invest in a real estate syndication from my Solo 401k Trust (Roth portion) with check privilege. My account is held at Fidelity as a non-prototype account invested in one of their mutual funds. I talked to Fidelity a few minutes ago and the rep explained that the funds ($100k) would have to be processed as a “sell” of the mutual fund shares to then processed the funds via wire.

By doing this, are there any tax implications?

Is is considered a distribution/income for tax purposes?

Any other questions/items that I should be aware of?

ANSWER:

- I understand that (i) you have a brokerage account at Fidelity for your Roth solo 401(k) funds which are currently invested in a mutual fund; and (ii) you wish to sell at least part of your mutual fund investment and then invest the proceeds in private placement. This confirms that the mere selling of one solo 401(k) investment in order to facilitate a subsequent solo 401(k) investment does not constitute a taxable transaction.

- Please see more below:

PRIVATEPLACEMENT RESOURCES:

My Community Form topics regarding private placements: Private Company/Private Placements – My Community (mysolo401k.net)

Please note that the investment must be a passive investment where your only relationship is investing your solo 401k funds (e.g. you can’t personally be an employee, vendor, lendor, etc. to the entity in which you are contemplating investing your Solo 401k funds).

· You wish to invest other funds in your Solo 401k in a private placement: Private Placement

· Please consider any sections of the subscription agreement that address ERISA and unrelated business income tax.

· If you choose to proceed you will, of course, be investing via the Solo 401k which means practically the following:The Document must be in the name of the Solo 401k where you sign as the Trustee;

· Use the EIN for the Solo 401k (e.g. if the provider issues a k-1 it will be very important that it does so under the EIN of the Solo 401k)

· The Solo 401k is a revocable retirement trust and for any date organized you would use the effective adoption date which is found on page 2 of the Adoption Agreement;

· If the subscription requires you to do so, please note that the Solo 401k is a self-directed employee benefit plan;

· If a W-9 is required: see https://www.mysolo401k.net/solo-401k/w-9-for-solo-401k-plan-how-to-complete-w-9-for-solo-401k-plan/

Self-directed Solo 401k Webinar – “How to” Invest in Private Placement/Private Equity

https://www.mysolo401k.net/solo-401k/private-company-investment/

Received Form 1099-R From Fidelity QUESTION:

I received a1099-R from Fidelity and want to know if it’s correct or an error. I am a client of My Solo 401k. Do I need them to make any corrections?

ANSWER:

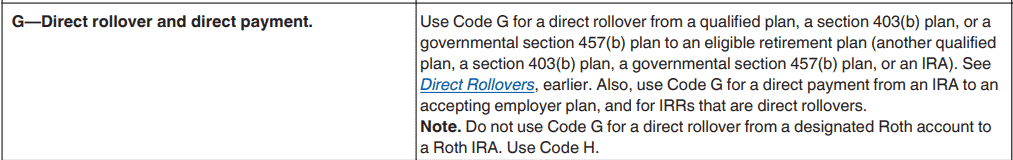

As long as a code “G” (direct rollover) is listed in box 7 of the Form 1099-R that Fidelity issued, no correction is needed. Here is what the following IRS instructions https://www.irs.gov/pub/irs-pdf/i1099r.pdf state:

In sum, when a pretax IRA or a pretax former employer plan such as a 401k is directly rolled over/transferred to another retirement plan such as a solo 401k plan, for example, the movement of the funds is reported on Form 1099-R, using code G, Direct rollover but not a taxable event.

Real Estate Purchase QUESTION:

Can we wire money directly from our Fidelity non-prototype account to the Closing/Title company for the solo 401k real estate property invesment?

ANSWER:

Yes, you can wire money directly from your Fidelity non-prototype account to the Closing/Title company for the solo 401k real estate property investment. See the following page for the wire directive form and directions on how to fill out the form. https://www.mysolo401k.net/solo-401k/fidelity-investments-wire-form-directive-for-solo-401k-alternative-investment-such-as-real-estate-promissory-note-and-private-investment/