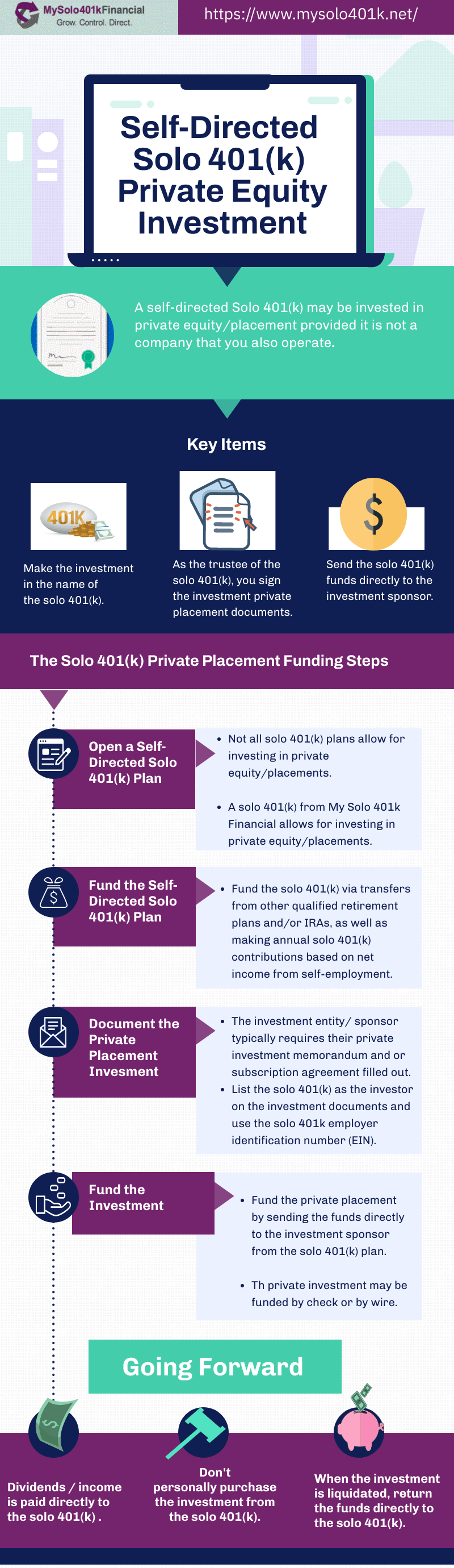

Self-Directed Solo 401k Private Equity/ Placement Investment (passive only) Purchase Procedure

Summary

This is a summary of how to invest/purchase private shares in a private company (e.g., C Corp., LLC, and Limited Partnership) with your Solo 401k—also referred to as Self-Directed 401k, Self-Directed Solo 401k, Solo K, Individual 401k or Single 401k.

Following are the general steps involved in the the private placement investment process.

Video Slides: Making a Self-directed Solo 401k Private Equity Placement Investment

The Typical Documents/Forms Provided by the Investment Sponsor/Entity

- Private Placement Memorandum/Offering Memorandum

- Articles of Organization

- Certificate from Secretary of State

- Subscription Agreement/Stock Purchase Agreement

- Accredited Investor Representations and Investor Questionnaire

- Depending on investment entity type, one of the following:

If Corporation: Company By-Laws

If LLC: Operating Agreement

If Limited Partnership: Partnership Agreement

- Additional documents to help determine if company will be successful:

Company’s latest Financial statements (for example, Balance Sheet)

Company’s 2 to 5 year financial forecast

Registering/Titling Investment Documents

Review and confirm that private investment documents for the following:

- Properly registered under the Solo 401k as the owner

- That the Solo 401k’s EIN is listed

- That you have signed as trustee of the Solo 401k

Example of how your Solo 401k’s investment interest in the entity should read:

Jane Do, Trustee of ABC Solo 401k Trust

Funding The Private Placement Investment

After all documents have been reviewed, approved and executed, it’s time to fund the investment by wire or by writing a check from your Solo 401k’s checking account made payable to the investment entity.

Ongoing maintenance

All investment gains must flow back to your Solo 401k’s checking account not your personal bank account.

Fiduciary QUESTION:

ANSWER:

Yes you still need to fill out the private investment document section dealing with the fiduciary, as the trustee of the solo 401k plan. Fiduciary and trustee mean the same thing in the context of a solo 401k plan. You would list the solo 401k plan and then sign on behalf of the solo 401k plan.

Traditional 401k plans (i.e., a plan sponsored by the Walmarts and Home Depots of the world) employ invesment fiduciairies but solo 401k plans for the self-employed don’t employ investment fiduciaries. Instead the business owner serves as his or her own trustee of the solo 401k plan.

Pooling Both Pretax and Roth Solo 401k funds for Private Investment QUESTION:

ANSWER:

It is important that the investment is documented (i.e., the subscription agreement is properly filled out) in the name of the Solo 401k and that the EIN for the Solo 401k is used for any reporting that is performed by the private investment sponsor resulting from the solo 401k investment. For example the Schedule K-1 (Form 1065) will need to be issued in the name of the solo 401k using the plan’s EIN.

Moreover, you will sign the private investment documents since you are the trustee of the Solo 401k.

If you invest both pretax and Roth solo 401k funds in the same private investment, it is deemed an investment by one solo 401k plan, just by different solo 401k fund source types.

Therefore, from an investment perspective, funds would flow to the private investment sponsors bank account from both the solo 401k prtax bank/brokerage account and the Roth solo 401k bank/brokerage account, so two checks or wires would be sent.

Then, once the private investment sponsor sends distributions, they would flow back to the solo 401k bank/brokerage accounts. However, it would be acceptable for administrative ease for all the returns on the investments (e.g. dividends) to flow back to one single solo 401k bank/brokerage account and then the funds can be divided between the pretax and Roth solo 401k bank/brokerage accounts based on the investment percentages.

1099-DIV & K-1 QUESTION:

During last year’s tax-prep season, I received a total of sixteen 1099s and K-1s filed against the EIN of my solo-401k. I ignored these (for the second consecutive year).

My solo 401k trust is a member of a private investment fund. Do I need to file the K-1 and 1099-DIV with the IRS?

ANSWER:

UBIT QUESTION:

ANSWER:

While a Solo 401k investment directly in real estate (i.e., the solo 401k takes title to the property) financed with non-recourse financing is exempt from the Unrelated Debt Financing Income (UDFI) tax, investing in a private inves,ent (real estate syndicate) could subject the solo 401k investment to another tax known as unrelated business income tax (UBIT) on pass-through income (e.g. if the Solo 401k owns an equity interest in an active business that provides goods and/or services and is taxed as a pass-through entity). Ultimately, it will depend on the specific facts and circumstances such that it would be prudent for the client to determine this in n consultation with his/her tax adviser. consultation with his/her tax adviser.

K-1 Issued to Solo 401k QUESTION:

ANSWER:

I understand that the K-1 is issued to the Solo 401k (and under the EIN for the Solo 401k) for investments made via the Solo 401k. In that case, any gains are on a tax-deferred basis since in the Solo 401k. Please simply keep the K-1 in your records.

How to Fill Out Subscription Agreement QUESTIONS:

ANSWER:

Here is the raw text, if useful…Employee Benefit Plan Information

◻ Yes ◻ No Investor is an “employee benefit plan” as defined in Section 3(3) of ERISA that is subject to the fiduciary provisions of ERISA (this includes U.S. pension plans and U.S. profit-sharing and 401(k) plans, “Multiemployer Plans” and “Taft-Hartley Plans” but does not include U.S. governmental plans, certain church plans and non-U.S. employee pension and welfare benefit plans).

◻ Yes ◻ No Investor is a plan as described in IRC Section 4975(e)(1) (e.g., U.S. individual retirement account, Keogh Plan).

◻ Yes ◻ No Investor is an insurance company investing the assets of its general account (or the assets of a wholly owned subsidiary of its general account), the underlying assets of which constitute “plan assets” within the meaning of Section 401(c) of ERISA.

◻ Yes ◻ No Investor’s underlying assets include “plan assets”, either by reason of investment by “benefit plan investors” (as defined in 29 C.F.R. 2510.3-101(f)) in a class of equity interests of Investor in an amount equal to 25% or more of the value of such class of equity interests (excluding for this purpose the value of any equity interests held by any person, other than a benefit plan investor, that has any discretionary authority or control with respect to the assets of the Investor or provides investment advice for a fee with response to such assets, or any affiliate of any such person), or for any other reason. Select yes if the solo 401k plan will owns 25% of more interest of the investment. This question appears to deal with the Plan Asset Rules which apply to self-employed solo 401k plans including solo 401k plans.

◻ Yes ◻No Investor is an “employee benefit plan” as defined in Section 3(3) of ERISA not subject to the fiduciary responsibility provisions of ERISA. Check no as a solo 401k plan is defined contribution plan not a DBP.

Additional Items to Consider when filling out a subscription agreement for an investment made using solo 401k funds.

- Please consider the sections of the subscription agreement that address ERISA and unrelated business income tax (which is referred to as “unrelated business taxable income” in the document).

- If you choose to proceed you will, of course, be investing via the Solo 401k which means practically the following:

- The Document must be in the name of the Solo 401k where you sign as the Trustee;

- Use the EIN for the Solo 401k;

- The Solo 401k is a revocable retirement trust and for any date organized you would use the effective adoption date which is found on page 2 of the Adoption Agreement;

- If the subscription requires you to do so, please note that the Solo 401k is a self-directed employee benefit plan;

- If a W-9 is required, it should be completed as follows.

1) Name: Enter name of Solo 401k plan2) Business Name/DBA: Leave blank3) Check the box in front of “Trust”4) Enter “Retirement Trust” in blank space after “Other”5) Enter “1” in blank space after “Exempt Payee Code”6) Enter address7) Leave SSN blank8) Enter 401k EIN in “Employer Identification Number” section9) Sign & Date.

Updating Investment Provider and Tax-Reporting Re IN-KIND TRANSFER QUESTION:

ANSWER:

1) Since the previous self-directed IRA custodian was instructed to process a direct rollover from your non-Roth IRA to the Solo 401k, the following would need to be communicated to the investment sponsor/provider:

- “My investment was processed as an IN-KIND NON-TAXABLE DIRECT ROLLOVER from my self-directed IRA to my self-directed Solo 401K, and “list the name of the solo 401k” is the name of my Solo 401K. As a result of the IN-KIND NON-TAXABLE DIRECT ROLLOVER of my IRA investment to my Solo 401K, this would not be reflected as a taxable distribution”

- Please also be sure to provide the investment provider with the EIN for the Solo 401k (e.g. if the provider issues a k-1 it will be very important that it does so under the EIN of the Solo 401k)

2) Please note that the rollover is reported by the self-directed IRA custodian and the IRA custodian would have provided you a 1099-R with a code “G” to report the rollover as a non-taxable direct rollover.

Disregarded Entity QUESTION:

One sponsor of a real estate private investment syndicate wants me to answer a question in the subscription agreement as to whether my self-directed Solo 401k trust is a disregarded entity. Here is the question: Is the solo 401k trust a disregarded entity for U.S. Federal tax purposes?

ANSWER:

Yes, the solo 401k is a disregarded entity as the investment gains flow back to the solo 401k plan and continue to grow on a tax-deferred basis (or tax free in the case of a Roth solo 401k), with federal taxes not applying until you commence making distributions (usually at retirement age) from the solo 401k plan.

In sum, the main purpose of a qualified plan including a solo 401k plan is to invest where the investment gains flow back to the solo 401k and maintain their tax deferred status unde the solo 401k plan as opposed to investing outside the plan where taxes on capital gains would typically apply.

Solo 401k Prohibited Transaction Rules as They Relate to Private Equity Investment

Considerations Regarding Private Equity Investments:

Fort those contemplating investing their solo 401k in an LLC/private placement investment.

(1) It is acceptable provided that (i) you (nor any closed related persons) are not working for the entity/investment provider in which you intend to invest retirement funds; (ii) you (nor any closed related persons) do not hold any ownership position personally in the entity in which you intend to invest retirement funds; and (iii) you (nor any closed related persons) otherwise do not have a relationship with this entity either in your own name or through an entity that you control (e.g. you are not a landlord, lender, vendor, etc.).

(2) The investment must be titled in the name of the Solo 401k with funds flowing from the Solo 401k account(s) and any return on the investment flowing back to the Solo 401k account(s).

(3) If the investment is structured as equity (e.g. stock in a corporation, membership interest in an LLC, etc.) the investment may be subject to unrelated business income tax if (I) the entity is an active business (e.g. providing goods or services) and (ii) the entity is NOT taxed as a C Corporation. If investment is structured as debt there is no unrelated business income tax issue as long as it is TRUE debt (e.g. some debt can be converted to equity such as a convertible note). Please see the following links for more information:

Additional Considerations Re Solo 401k Private Placement Investments

- Please consider any sections of the subscription agreement that address ERISA and unrelated business income tax.

- If you choose to proceed you will, of course, be investing via the Solo 401k which means practically the following: The Document must be in the name of the Solo 401k where you sign as the Trustee;

o Use the EIN for the Solo 401k (e.g. if the provider issues a k-1 it will be very important that it does so under the EIN of the Solo 401k)

o The Solo 401k is a revocable retirement trust and for any date organized you would use the effective adoption date which is found on page 2 of the Adoption Agreement;

o If the subscription requires you to do so, please note that the Solo 401k is a self-directed employee benefit plan;

o If a W-9 is required: see https://www.mysolo401k.net/solo-401k/w-9-for-solo-401k-plan-how-to-complete-w-9-for-solo-401k-plan/