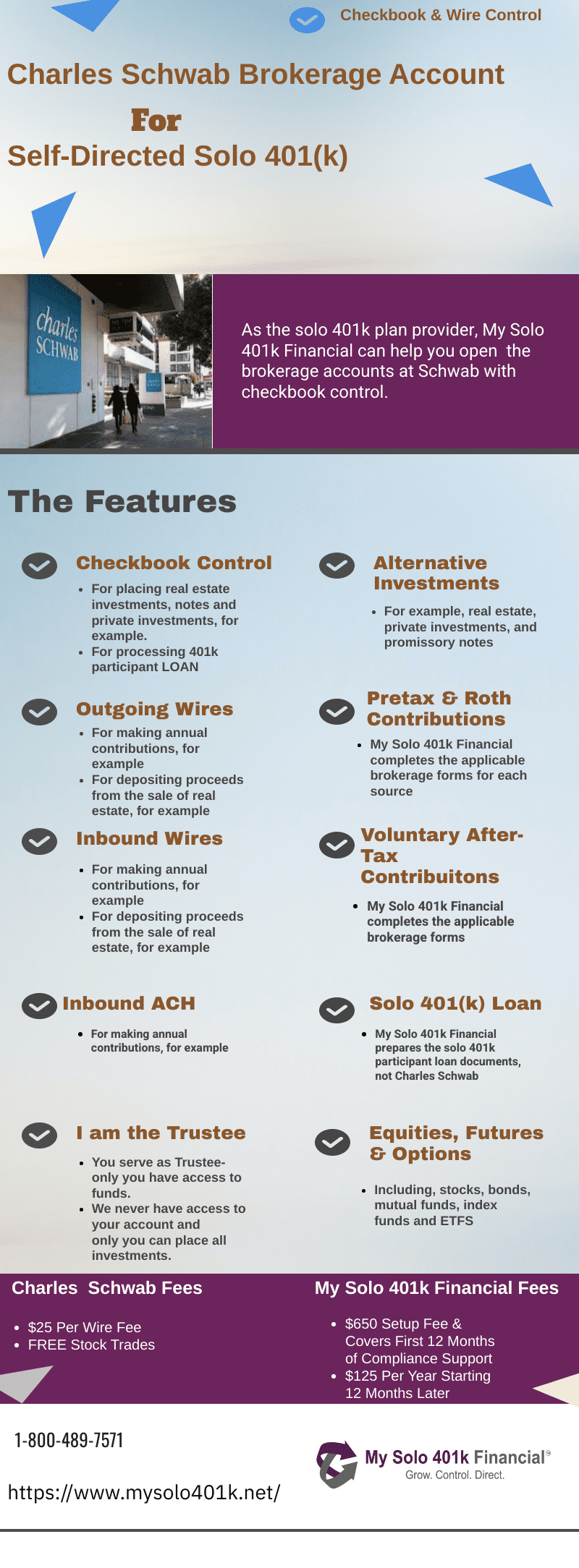

A Schwab Solo 401k brokerage account with checkbook control from My Solo 401k Financial is ideal for those looking to still have the option to invest in equities while also gaining checkbook control over their retirement funds to invest in alternative investments like real estate, notes, and private equity, for example. This arrangement also allows for solo 401k participant loans.

A Schwab Solo 401k with checkbook control comes with the following features:

Checkbook

Fund Solo 401k alternative investment purchases, e.g., real estate, precious metals, tax liens, promissory notes, private placements, etc. by writing checks from the Solo 401k Schwab brokerage account.

Solo 401k Loan

After we prepare Solo 401k loan documents, process Solo 401k loan directly from the Solo 401k plan Schwab brokerage account.

Brokerage Account

Continue to trade equities and grow your retirement funds tax-deferred, deposit investment gains from your Solo 401k’s alternative investment holdings (e.g., rent check proceeds from real estate) directly into your Solo 401k Schwab brokerage account, and make your annual Solo 401k contributions directly into the brokerage account.

How it works

Charles Schwab is simply providing brokerage accounts for your Solo 401k, and My Solo 401k Financial is your Solo 401k provider. In other words, even though Schwab also offers Solo 401k, their Solo 401k plan document restrict you to only investing in stocks and mutual funds; however, by using our Solo 401k document, which allows you to serve as trustee of the Solo 401k and invest in alternative investments such as real estate, precious metals, tax liens, promissory notes, private stock, etc., as well as process Solo 401k Loan, Schwab is not involved in the administration of the Solo 401k.

Mega Backdoor Roth Solo 401k Using Charles Schwab Brokerage Accounts

After-Tax to Roth IRA Conversion Form

Documents for Opening Schwab Solo 401k Brokerage Account

To open Schwab Solo 401k with checkbook control, you will need to submit My Solo 401k Financial solo 401k plan documents, which we prepare in 24 hours, along with Schwab’s applicable brokerage account forms and checkbook paperwork, which My Solo 401k Financial will complete for you.

Fees Charged by Charles Schwab

Because Schwab is simply holding the funds in a brokerage account under the solo 401k offered by My Solo 401k Financial, the only fees that apply to the Schwab brokerage account are:

Stock trading fees : Zero

outgoing wire fees of $25.00.

Options QUESTION:

I have a self-directed solo 401k that I opened with your company with funds sitting in a non interest bearing bank account. I went to Schwab to transfer some funds so that I could do some trades, including options. They told me with a single 401k account, I could only be approved for a level zero or covered options trading. Is there something somewhere that states differently – such as being able to trade options without owning the underlining stocks?

ANSWER:

While Schwab is of course free to set the terms of their accounts, they may have understood that you were asking about a solo 401(k) provided by Schwab as opposed to opening a brokerage account where the self-directed solo 401k plan is provided by another company such as My Solo 401(k) Financial. You may wish to call back and clarify – specifically, you would be opening a Schwab company retirement account which is the type of account that Schwab opens for our clients. If you wish to open a brokerage account at Schwab for the self-directed solo 401k that we offer, please let us know so that we can prepare the required Schwab documents.

Institutional Brokerage Accounts QUESTION:

I am an advisor. Can the brokerage accounts for the self-directed solo 401k be opened on the Charles Schwab institutional side?

ANSWER:

Yes, we can assist in opening the brokerage accounts on the Schwab institutional side instead of the retail side. Based on experience and feedback from other clients’ advisors, the advisor submits the paperwork to the Schwab advisor portal. We are also happy to submit to the back office as we do with those clients that are opening a non-Institutional account.

Transfer Existing Schwab Individual 401k Question:

ANSWER:

Good question, and the quick answer is yes. More specifically, the IRS rules allow for the change from one solo 401k plan provider company to another. This type of change is known as a plan restatement because the self-employed business is not shutting down the 401k plan but rather switching from Schwab as the 401k provider to a company like My Solo 401k Financial as the new self-directed solo 401k provider.

We have found this to be quite common (i.e., where an Individual 401k client at Schwab decides they would still like to use Schwab to hold the funds but would now like to use our company as the new solo 401k plan document provider). Such an arrangement will result in opening new brokerage accounts at Charles Schwab for the self-directed solo 41k that we offer ( we would draft new solo 401k plan documents). Subsequently, we would prepare a Schwab Individual 401k internal transfer form so that they can move the existing cash and securities in-kind to the new self-directed solo 401k brokerage account. Once the new account has been funded, Charles Schwab will then issue a checkbook in the name of the solo 401k plan which can be used to place alternative investments such as real estate, notes, private equity, metals, and tax liens, to name a few. The checkbook can also be used to process the solo 401k participant loan funds as our plan allows for loans. Lastly, we would handle all the necessary paperwork to make this transition happen.

Financial Advisor Question:

ANSWER:

Yes you should still be able serve as your client’s adviser under the Charles Schwab brokerage account for the self-directed solo 401k plan that we offer which also allows for investing in physical real estate in addition to equities. However, you can ultimately confirm with Schwab if you will need to file any additional adviser forms with them.

Private Investment Question:

While the Schwab brokerage account for the new self-directed solo 401k is being established, do we need to fill any other form or paper work with real estate guys for purchase of shares. their lawyer is preparing the paperwork I can ask them to send once they are ready.

ANSWER:

Brokerage Account Name Question:

Thanks to your help, the brokerage account for my new self-directed solo 401k with checkbook control appears to be open. I noticed a new account listed within my other accounts today and it is titled “Pension Account”. Is this correct for us needing a check book control and brokerage account for our Solo 401K? There may be times in which we invest in stocks and times in which we need to generate a participant loan.

ANSWER:

- Schwab Pension Trust Account also known as CRA (Company Retirement Account) is for a self-directed solo 401k, and with this account you will receive a checkbook and it’s a free account. Anything solo 401k related is through us as your plan provider, so the loan process will be through us and not Schwab. Schwab will not handle tax reporting applicable to the solo 401k plan. Tax reporting is part of our services. Please let us know when you are ready to take a Solo 401k participant loan, and we will prepare the required solo 401k loan documents.

- The name “Pension Account” can be relabeled once you log on to your Schwab brokerage account to list your solo 401k trust plan name.

Outgoing Wire for Real Estate Investment Question:

Is there any risk that this creates a taxable event?

ANSWER:

Naming the Schwab Brokerage Accounts Question:

Charles Schwab has opened the 3 solo 401k brokerage accounts (pretax, Roth and voluntary after-tax). How do I label them as such so I can easily distinguish them when viewing them on-line?

ANSWER:

Convert Voluntary After-Tax Solo 401k Funds to Roth Solo 401k Question:

I recently contributed $56,000 as a 2019 (tax return extension was filed) after-tax contribution to my Solo 401k plan and would like to do an in-plan conversion to Roth solo 401k bucket. I was going to instruct Schwab to move the funds from the After-Tax account to the Roth account. Is there anything else I need to do for you to process the conversion? No income has accrued yet.

ANSWER:

A specific procedure applies. Since we are the solo 401k plan document provider (it is not a Schwab Solo 401k , but schwab is holding the solo 401k funds), we need to document and report the 2020 in-plan conversion

Making Contributions by Check to Schwab Brokerage Accounts For the Self-Directed Solo 401k

Making Contributions Electronically to Schwab Brokerage Accounts For the Self-Directed Solo 401k

- One option is to open an account at a bank in the name of the Solo 401k so that you can make contributions to the bank account (which would count as contribution to the plan since in the name of the plan) and then electronically transfer funds from the Solo 401k bank account to the brokerage account at Schwab.

- A second option is to open a brokerage account at Schwab in your name, fund the brokerage account in your name, and then transfer the funds from the brokerage account in your name to the brokerage account in the name of the solo 401k plan (subject to the contribution limits, deadline, etc.).

The setup of separate Schwab brokerage accounts for each participant and source of funds (i.e., pretax, roth and voluntary after-tax) is how solo 401k contributions are tracked.

Do You Recommend Using Charles Schwab for the Self-Directed Solo 401k Brokerage Accounts QUESTION:

Do you recomment using Charles Schwab for the brokerage accunts for the self-directed solo 401k?

ANSWER:

Allow for Roth & Voluntary After-Tax Solo 401k Contributions QUESTION:

just received my pre-filled Charles Schwab setup docs from My solo 401k Financial. Can someone please confirm if the Schwab account also allows for Roth solo 401k contributions as well as voluntary after-tax solo 401k contributions?