Now that the solo 401(k) plan documents have been drafted and provided for your signature, the next step is to obtain the employer identification number (EIN) for the solo 401(k) retirement trust.

Obtaining the EIN for the solo 401(k) plan is covered in our setup fee; however, we will need your social security number in order to obtain the EIN. Therefore, if you prefer to obtain the EIN yourself, you can do so in a matter of minutes via the IRS website.

CLICK HERE to go directly to the IRS EIN page.

We discussed the need to obtain a separate EIN for the Solo 401k on our Daily Live Webinars on our My Community (Free to Join! All are Welcome!):

We have also provided the following steps once you click above that will need to be followed carefully when obtaining the EIN for the solo 401(k).

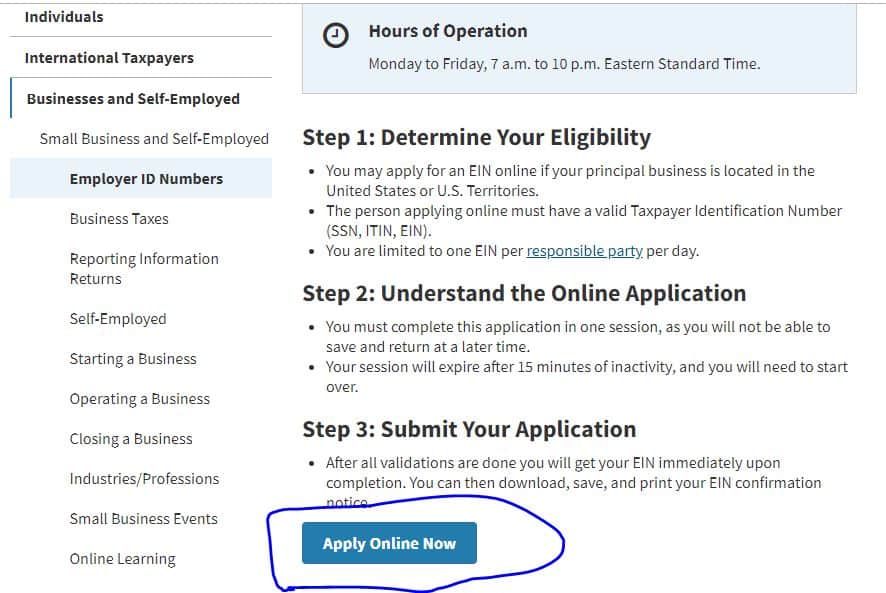

Step 1:

Click on “apply online now.”

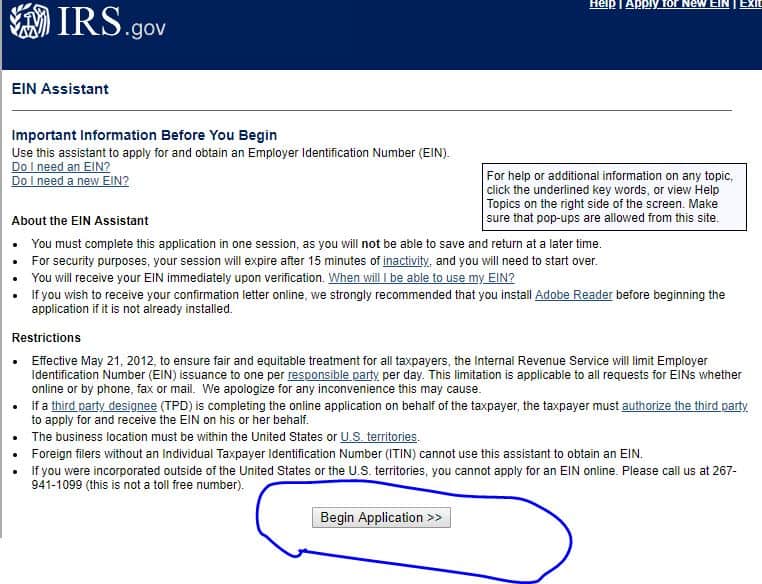

Step 2:

Click on “Begin Application.“

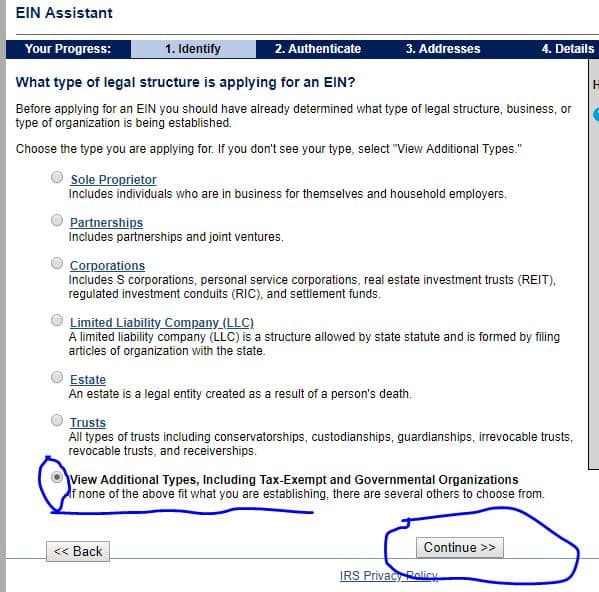

Step 3:

Step 3:

- Check off “View Additional Types…” and click on “continue.”

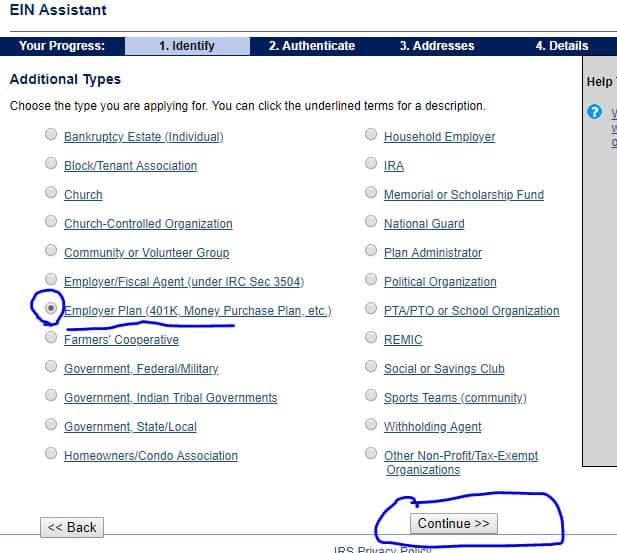

Step 4:

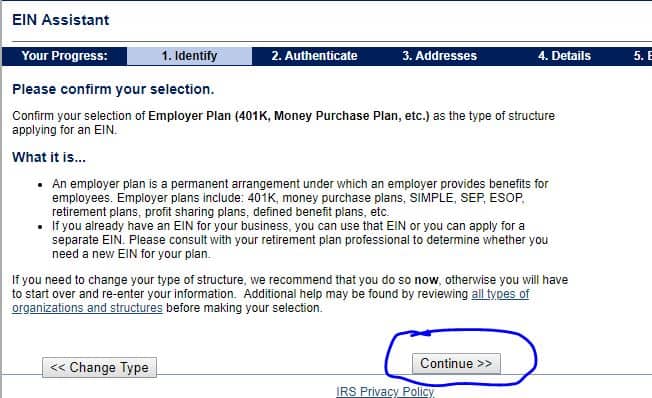

- Check off “Employer Plan (401K, Money Purchase Plan, etc.),” and click on “continue.”

Step 5:

Step 5:

Click on “continue.”

Step 6:

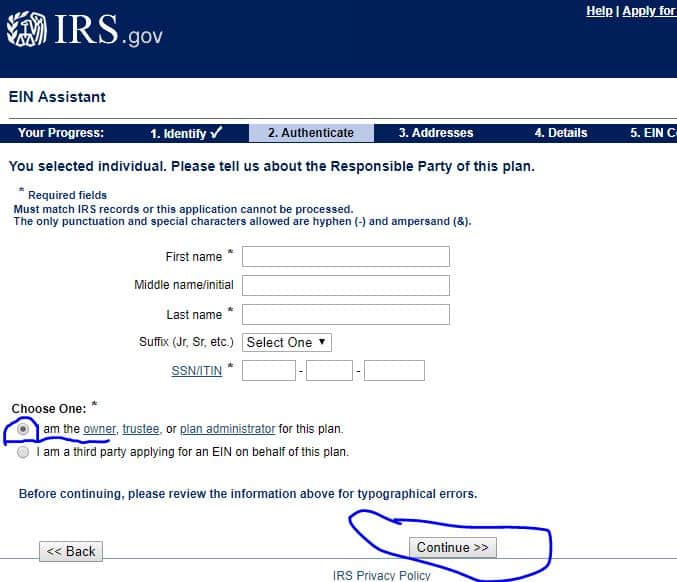

Enter you name, social security number, and check off “I am the owner, trustee…,” and click on “continue.”

Step 7:

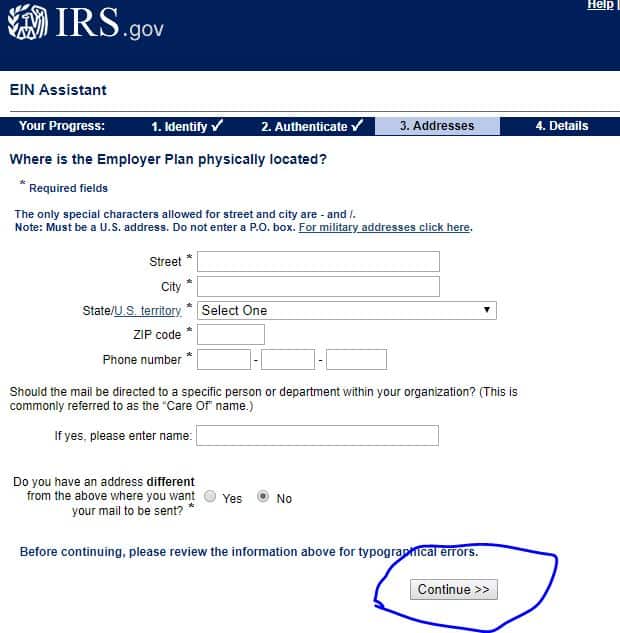

Enter your home or business address, phone number and click on “continue.”

Step 8:

Step 8:

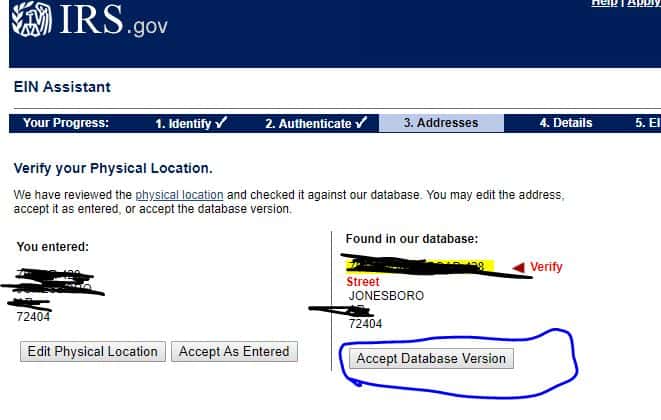

Click on “accept database version.”

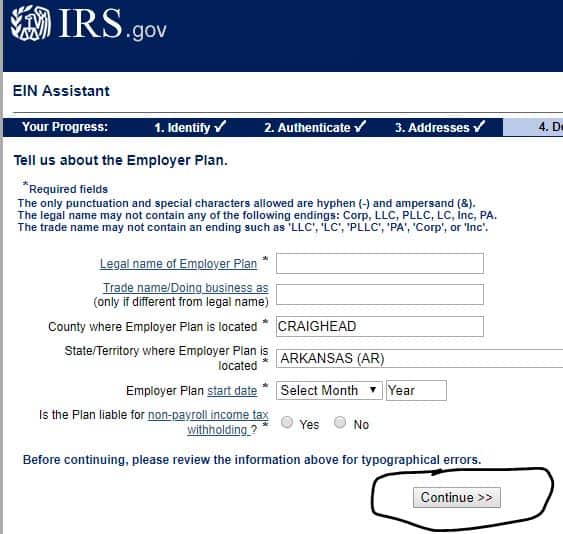

Step 9:

Step 9:

For “Legal Name of Employer Plan” enter the name of the solo 401(k) plan as listed on page 1 of the Adoption Agreement.

For “Trade Name/Doing Business as” leave this blank

For “County where Employer Plan is located” – if not already populated enter your state county

For “State/Territory where Employer Plan is Located” – enter your state

For “Employer Plan Start Date” enter January and the current year if the plan was opened in 2020.

For “Is this Plan Liable for non-payroll income tax withholding?” — enter NO

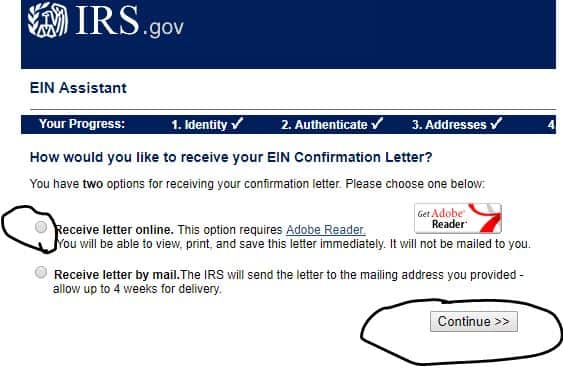

Step 10:

Check off “Receive letter online,” and click “continue.”

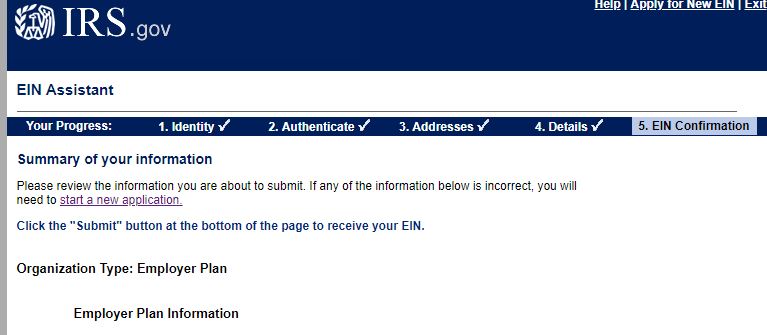

Step 11:

Step 11:

Review and then click on “submit.”

Step 12:

Write down your EIN, print and save a copy for your records and then click on “continue.”

You are done! Please make sure to save a copy of the EIN for your records and provide a copy for our records.

- When we assist you in opening the solo 401(k) bank or brokerage account, the bank or the brokerage firm will ask for the EIN as they will need it for reporting purposes.

- Since a Solo 401(k) is a qualified retirement plan, it has to be sponsored by a business entity. The EIN is for the solo 401(k), not for your self-employed business.

- For more on the IRS view on the importance of using the solo 401(k) EIN for reporting purposes, please CLICK HERE.

EIN QUESTIONS:

ANSWER:

EIN For Each Participant QUESTION:

ANSWER:

Separate EIN QUESTION:

ANSWER:

Othe Forms EIN QUESTION:

Internal Revenue Code Section 501(c)(3), organizations must complete a Form

1023-series application for recognition. All other entities should file Form 1024 if

they want to request recognition under Section 501(a).

Nearly all organizations claiming tax-exempt status must file a Form 990-series

annual information return (Form 990, 990-EZ, or 990-PF) or notice (Form 990-N)

beginning with the year they legally form, even if they have not yet applied for or

received recognition of tax-exempt status.

Unless a filing exception applies to you (search www.irs.gov for Annual Exempt

Organization Return: Who Must File), you will lose your tax-exempt status if you fail

to file a required return or notice for three consecutive years.”

ANSWER:

- Neither 1023 nor 1023 apply because those forms only applies to organizations filing for tax exempt status under 501(a) or 501(c)(3) (e.g. schools, charitable foundations, etc. as applicable).

- 990-t is used to report unrelated business income tax and would not apply to a Solo 401k unless it holds an equity position in an business that is not taxed as a C-corporation.