A Self-Directed IRA LLC from My Solo 401k Financial puts you in control of your retirement funds. You will gain option to make allowable investment purchases by simply writing a check, resulting in the elimination of transaction and holding fees.

Payment of Fees:

1) My Solo 401k Financial Fees (One-Time Fee): $800

2) Fees Associated with State LLC Fee Structure:

- Required Filing Fees (varies by state) for LLC articles of organization and charged by the state.

3) IRA Custodian Fees: ongoing IRA custodian annual fee, which you will submit directly to the IRA custodian

While you are free to choose your own IRA custodian provide they will hold a LLC on their books, some custodians that will hold the LLC on their books are Forge Trust (formally IRA Services Trust Company), IRAR Trust Company, and Kingdom Trust. Important Note: To stem liability and to avoid the increased possibility of investment-related consequences (i.e., having all your eggs in one basket), you may want to stay away from companies that play both sides of the field (i.e., have a sister companies-one that offers the IRA LLC and the other that serves as the IRA custodian of the IRA that holds the LLC on their books) .

To review Forge Trust (formally IRA Services Trust Company (the custodian of the self-directed IRA) Fee Schedule click on the following link:

Custodian Establishment and Annual Fee: If you use Forge Trust (formally IRA Services Trust Company)

- No fee to open IRA account (online)

- Funding of LLC $25.00 (charged from IRA at time of wire transmission of IRA funds to LLC Bank Account)

- $50 quarterly fees and $25 quarterly asset fee (Total Annual Fee is $300.00) (Charged by Forge Trust Company)

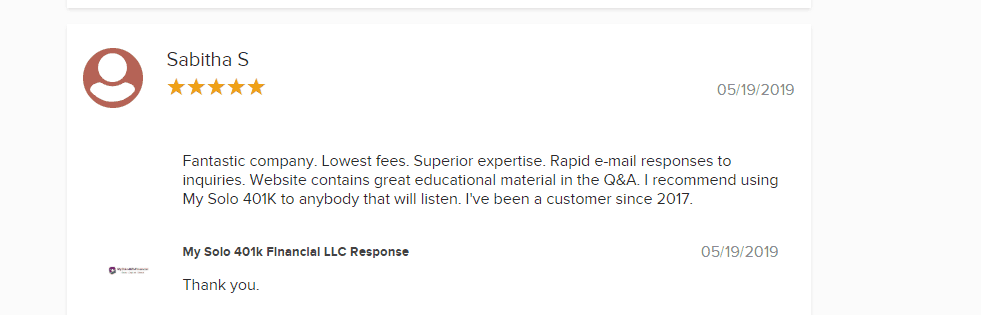

Better Business Bureau Client Review

For a full list of over 100 client reviews, CLICK HERE.