TD Ameritrade Solo 401k Brokerage Account from My Solo 401k Financial

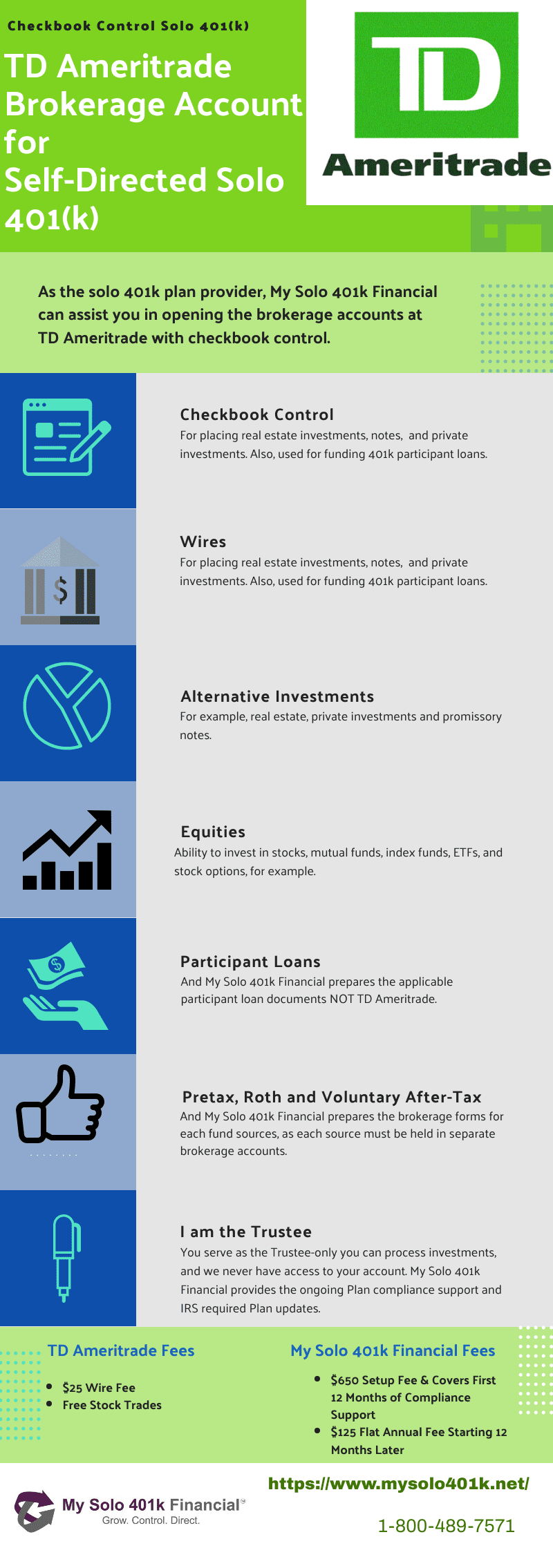

A TD Ameritrade Solo 401k brokerage account with checkbook control from My Solo 401k Financial is ideal for those looking to still have option to invest in equities while also gaining checkbook control over their retirement funds for investing in alternative investments such as real estate, tax liens, promissory notes, private shares as well as processing solo 401k participant loans.

TD Ameritrade Solo 401k with checkbook control allows for the following

Checkbook

Fund Solo 401k alternative investment purchases, e.g., real estate, precious metals, tax liens, promissory notes, private placements, etc. by writing checks from the Solo 401k Ameritrade brokerage account.

Solo 401k Loan

After we prepare Solo 401k loan documents, process Solo 401k loan directly from the Solo 401k plan Ameritrade brokerage account.

Brokerage

Continue to trade equities and grow your retirement funds tax-deferred, deposit investment gains from your Solo 401k’s alternative investment holdings (e.g., rent check proceeds from real estate) directly into your Solo 401k Ameritrade brokerage account, and make your annual Solo 401k contributions directly into the brokerage account.

How it works

TD Ameritrade is simply providing brokerage account for your Solo 401k, and My Solo 401k Financial is your Solo 401k provider. In other words, even though Ameritrade also offers Solo 401k, their Solo 401k plan document restrict you to only investing in stocks and mutual funds; however, by using our Solo 401k document, which allows you to serve as trustee of the Solo 401k and invest in alternative investments such as real estate, precious metals, tax liens, promissory notes, private stock, etc., as well as process Solo 401k Loan, Ameritrade is not involved in the administration of the Solo 401k.

Documents for Opening TD Ameritrade Solo 401k Brokerage Account

To open Ameritrade Solo 401k with checkbook control, you will need to submit My Solo 401k Financial Solo 401k plan documents, which we prepare in 24 hours, along with Ameritrade’s special brokerage account forms and checkbook paperwork.

Transfer IRA QUESTION:

I currently have some idle cash (along with some stocks/mutual funds) in a regular IRA with TDAmeritrade, I assume I can roll/transfer the cash part only into a solo 401K? And without incurring a tax penalty or obligation of any sorts? I have had the IRA account for a number of years, and have not contributed this year.

ANSWER:

Correct that you can transfer all or part of the IRA to a self-directed solo 401k provided by our company. You can even process an in-kind transfer of the equities held in the IRA to the solo 401k. We can also assist you in setting up the brokerage account with checkbook control at TD Ameritrade for the solo 401k that we offer. We would fill out all of the required TD Ameritrade brokerage forms as well as the IRA transfer form. The transfer form would include instructions asking TD to transfer the IRA internally and in-kind to the new solo 401k brokerage account. The movement of the TD Ameritrade IRA to the solo 401k brokerage account would be deemed a “direct rollover” so not taxes would apply.

Transfer Existing Solo 401k at TD Ameritrade QUESTION:

I have a Solo 401k plan at TD Ameritrade now and I manage myself. I am considering to transfer administering of my account to your company. Have some questions

QUESTION 1: what is the fee (set up or annual)?

ANSWER 1: We charge $650 for the set up and $125 yearly starting 12 months later. Please see the following link for more information on the pricing. https://www.mysolo401k.net/solo-401k/solo-401k-pricing/

QUESTION 2: Do you charge any percentage of my assets or just charge flat fee?

ANSWER 2: We just charge a flat fees as outlined above.

QUESTION 3: Can I still use my current TD Ameritrade account to manage my assets (buying , selling at TD Ameritrade)?

ANSWER 3: While you can still use TD Ameritrade, TD Ameritrade requires that you set up a new brokerage account for the Solo 401k that we offer. We would help you in internally transferring the existing TD Ameritrade Solo 401k to the new solo 401k plan with us. This will be considered a non-taxable event and you existing securities can also be transferred in-kind.

QUESTION 4: What is the procedure to transfer my TD Ameritrade Solo 401k to your company?

ANSWER 4: First, we will need to restate your existing solo 401(k) to our plan. Please see the following link for more information on this. https://www.mysolo401k.net/change-solo-401k-provider-real-estate-401k-provider-self-directed-solo-401k-provider-self-directed-401k-provider-mysolo401k-www-mysolo401k-net/

The next step is to fill out our online application using the following link. https://www.mysolo401k.

You can also give us call, and we will gladly walk you through the application. We will then handle the entire set up, from restating the existing plan to our plan to helping you set up the new brokerage account at TD Ameritrade as well as filling out he internal solo 41k transfer form processing an internal, in-kind transfer of the existing Solo 401k to the new solo 401k plan.

Here is a diagram of changing from an existing TD Ameritrade solo 401k to a checkbook solo 401k with with us whereby you can continue to use TD Ameritrade’s brokerage services if you so desired.

Fees for Account Set up QUESTION:

Thank you very much for all of the info, it’s been super helpful. If I were to use TD Ameritrade, for example, as my brokerage firm. Do either you at My Solo 401k or TD Ameritrade charge any fees for setting up that style of account?

ANSWER:

No, there are no fees associated with setting up a brokerage account at a brokerage firm. The only fees that would be charged would be trading fees, or wire-out fees but no “maintenance fees”. This is because for example, TD, is only a custodian of the cash (e.g. holding the cash/securities) but is not a custodian of any investment documents, nor responsible for any reporting on your account so such fees are not applicable. Please see the following link regarding “Who is the Custodian” which I think will fully answer your question: https://www.mysolo401k.net/cus

I Called TD Ameritrade About Post Tax Account QUESTION:

I also have called into TD and they told me they do not offer the post tax 401k designated account, how do you make it so that the account is that type while still having them as the brokerage?

ANSWER:

TD’s proprietary 401k Plan does not offer the post tax 401k designated option; however, when you sign up with us, you are adopting our Third Party Provider Plan which does allow for after-tax and roth contributions. Many people adopt our Third Party Provider plan to be afforded access to these options. The “Plan” governs what you are and are not allowed to do under the Plan Terms (in accordance with the 401k rules and regulations of course.). Again, TD will just be holding your funds and will not be responsible for any compliance reporting or support under your plan – we will be providing that service.

Credit Card Account QUESTION:

TD Ameritrade offers a check with this account. Assuming I use this solo 401k to buy and fix a house, is there any problem using a credit card to pay to renovations etc?

ANSWER:

Keep Funds at TD Ameritrade & Additional Account at Trade Station QUESTION:

I currently have a 401K Solo at TD Ameritrade, but I would like to use a different broker like Trade Station or WeBull. Am I able to have my 401K at multiple brokers? Have you setup accounts for people who want to use Trade Station or WeBull?

ANSWER:

Capital Gains QUESTION:

My Solo 401K has investments in Stocks through a TD Ameritrade account. The account is showing a short term capital gain for 2020 of about $10,000. The TD Ameritrade Account in in the name of the Trust we set up for the Solo 401K. Is the Trust going to have to pay any Taxes on this Short Term Gain or is it exempt?