Congratulations on your decision to start self-directing your hard-earned money by deciding to open a Self-Directed Solo 401(k). By furnishing us with some important information, you can establish your Solo 401(k) plan.

Step 1

Collect and Provide Information

STEP 2

Make Payment

$525 Setup Fee +$125/Yr = $650 Today

To Pay on-line, CLICK HERE.

For more on pricing, Click here.

Two ways to pay:

1) Pay online by clicking here.

2) Call us at 800.489.7571 to make payment.

STEP 3

Begin investing!

Upon receipt of above information and payment, we will prepare the solo 401k establishment documents the same day, e-mail the downloand link and assist you in completing the forms and opening the bank or brokerage account(s).

List of Solo 401k | Self-Directed 401k Documentssa

- Solo 401(k) Adoption Agreement

- Solo 401(k) Trust Agreement

- Solo 401(k) Plan Document

- IRS Opinion/Determination Letter

- Beneficiary Designation

- Entity Type Adoption

- Our Agreement for Services for you to review and accept

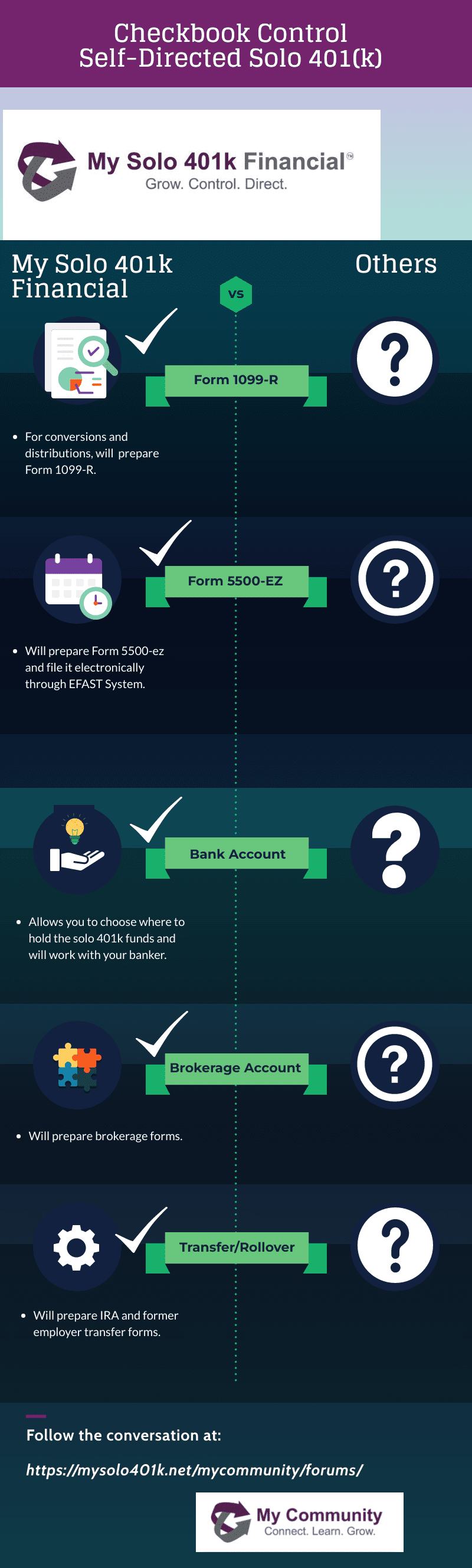

Other Forms

- Solo 401k Participant Loan Forms

- Transfer/Rollover Forms

- Bank Guide for opening Solo 401k Checking Account

**Free Self-Directed Solo 401k**

Our self-directed solo 401k plan is now eligible for up to $1,500 in dollar-for-dollar tax credits. Visit here to learn more.

Better Business Bureau Client Review

For a full list of over 100 client reviews, CLICK HERE.